Market Analysis

Import For Trade: It is important to carryout a feasibility analysis and feasibility of the goods to be imported.

• Competitive Goods : The place, quality, distribution channels, promotional activities, price, packaging, customer service and similar information of competing goods in the market should be observed.

• Existing Buyers, Competitors : Information about current buyers (quantities and frequency of purchase) and information about competitors (competitors, who they are, where they are, who sells goods, characteristics of customers, purchasing methods, strategies and goals and so on) are important in terms of marketing the goods in the market.

• Cost : The cost of importing goods should be worked out precisely. In addition to the price of your merchandise, any taxes (customs duty, vat, special consumption tax, financial liabilities, transportation, insurance, customs commission expenses etc.) should be determined clearly.

Imports for Enterprises' Own Needs : In the instance that imports are used in production, the need for quality, low-cost products would be preferential..

• Fair, Exhibition, Face to Face Interview: Trade Fairs are one of the easiest and most efficient ways to find a dealer for developing one-to-one relationships. It is important when visiting trade fairs, exhibitions and similar organizations to make contact with exporters and to carryout good market research.

• vInternet: Widely used in international trade transactions it, can easily and quickly reach out to foreign suppliers and customers.

Name of imported goods and Customs Tariff Statistics position (G.)T.I.P) number shall be determined in the light of all the information and documents (catalogue, technical content, sample) available by the importer before the import. It is also possible to obtain information from a customs consultant from the Ministry of Economy () and Ministry of Customs and Trade (www.gtb.gov.tr).

In this framework, if any, the investigation of the demand for documents such as standards, guarantee certificate, inspection certificate, inspection certificate, health certificate, analysis report, CE certificate etc., which are subject to restrictions such as prohibition, permit, quota, special customs application etc It is very important to do pre-prepare. This information can be accessed from the Ministry of Economy (www.ekonomi.gov.tr), Ministry of Customs and Trade (www.gtb.gov.tr) and Istanbul Chamber of Commerce (www.ito.org.tr).

Foreign trade legislation is subject to frequent changes. Therefore, even if the goods have been imported before the introduction of the import activity, it is necessary to review the legislation.

It is possible to obtain information on the tariff rates to be applied in imports on the website of the Ministry of Economy (www.ekonomi.gov.tr). However, since the customs duty rate may have changed, it is possible to obtain information from the trade and / or industry chambers, customs consultancy companies or the internet portals which include the updated legislation in electronic media by specifying the import country on the basis of custom tariff number.

Each transport route has its advantages and disadvantages. Which way to choose the transportation of imported goods; it depends on the product, the importer's needs, the route of the country of the exporter. Price, due date, special conditions related to the product are important to bear in mind regarding transportation.

It is an important element in terms of ensuring safe transportation of imported goods from the producer to the consumer. While packaging, product-specific features and needs to be remembered. All information on the packaging should be provided with clear, water-resistant ink.

After the connection with the potential seller, the importer and the exporter should discuss the issues mentioned below;

• The name, type, quality of the product to be imported,

• Whether or not to make a sample of the required property,

• Type of packaging,

• Validity of the price and price requested by the seller for the product,

• Import amount and its effect on price,

• Payment methods and bank guarantees

• Whether an advance payment is made or not,

• Delivery times and loading times of goods to be imported,

• Transport,

• The documents required for the importation of the products to be made in accordance with our legislation,

• After-sales warranties, spare parts and service trainings.

It is useful to create a sales contract that includes goods movement or currency movement against all risks that may occur in the trade of goods subject to importation, although not mandatory.

In order to regulate the reciprocal movement of goods and goods subject to trade in foreign trade between the parties, various payment methods such as prepayment, goodwill, voucher, letter of credit, acceptance credit are available.

It is very important for importers to determine the most appropriate payment method which is accepted by the exporters.

Because import is very important in terms of tax revenues of the state, importers should not underestimate that import duties in the customs are strictly controlled and that imports may have some implications for non-tariffs due to the negative impact of imports on domestic production.

Most of the preferential tariff applications and trade policy measures depend on the origin of the goods. Therefore, the origin of the goods must be declared correct.

If it shows that it is manufactured in a country other than the country where it is produced or if it carries the name or symbols that give rise to such an impression, it is not allowed to import because it is an object of false origin.

Import customs operations should be considered. If there are deficiencies on the basis of documents in the customs stage, the goods may stay longer than expected at customs and additional costs such as demurrage, reimbursement or return of goods (return to the country of origin) may be incurred. Importance should be given to customs clearance and financing of imports.

People wishing to import should apply directly to the customs authorities with the documents they need to take in accordance with the relevant legislation.

In the importation of some products, some documents must be received or approved by the relevant institutions and organizations in accordance with the below mentioned communiqués.

• Certificate of Conformity from TSE,

• Control Certificate from Ministry of Food, Agriculture and Livestock and Ministry of Health,

• Guarantee certificate to be approved by the Ministry of Science, Industry and Trade,

• Control Certificate / Certificate of Conformity / Chemical Material Import Certificate from Ministry of Environment and Urbanization,

• Import Monitoring Certificate / Surveillance Certificate from Ministry of Economy,

• Certificate of Conformity from Tobacco, Tobacco Products and Alcoholic Beverages Market Regulatory Authority.

It is obligatory to submit some documents from various institutions such as above before the import to the entrance customs office. Otherwise, imports are not allowed.

It is very important to examine the related notifications about the documents that should be taken from the various institutions. Because, in the related notifications, many exemptions have been granted to the importing companies, provided that the conditions stated in the notifications regarding the provision of the requested document are met.

• Original invoice,

• Asset notification form for imported goods,

• Certificate of origin,

• EUR.1 Movement Certificate (Free Trade Agreements covered by ECSC products and EU origin agricultural products), A.TR Movement Document (Customs Union Agreement in the importation of industrial and processed agricultural products),

• Check list,

• Lading or delivery receipt,

• Freight bill and / or insurance policy,

• Processed agricultural products declaration form / analysis report,

• Certificate of conformity

, • Compliance letter,

• Certificate of approval,

• Warranty certificate,

• Permission letter / permit,

• Fund receipt (receipt issued by bank or private financial institution deducting the Resource Utilization Support Fund for goods imported in accordance with term letter of credit, goods and acceptance and credit payment),

• Import license,

• Inspection certificate.

The owners of the goods to be imported or those who are authorized to act in their place, to be able to make their statements correctly and not to face penalties due to the false declaration, to obtain the written permission from the customs office, provided that they have the temporary storage place under the supervision of temporary storage location and customs officers, such as the examination, not to be a commercial nature provided that they can take samples and make appraisal reviews.

Refund is possible if the goods are not suitable for the order. Performing a quality control at the loading stage in the export country can reduce costs.

Additional costs;

• Transport,

• Insurance,

• Clearance costs,

• Bank charges,

• Domestic transportation costs,

• Fund costs depending on payment method,

• Certification costs that may be required for the product

Imports for Enterprises' Own Needs : In the instance that imports are used in production, the need for quality, low-cost products would be preferential..

Access to Vendor Companies

• Fair, Exhibition, Face to Face Interview: Trade Fairs are one of the easiest and most efficient ways to find a dealer for developing one-to-one relationships. It is important when visiting trade fairs, exhibitions and similar organizations to make contact with exporters and to carryout good market research.

• vInternet: Widely used in international trade transactions it, can easily and quickly reach out to foreign suppliers and customers.

Determination Of Imported Goods

Name of imported goods and Customs Tariff Statistics position (G.)T.I.P) number shall be determined in the light of all the information and documents (catalogue, technical content, sample) available by the importer before the import. It is also possible to obtain information from a customs consultant from the Ministry of Economy () and Ministry of Customs and Trade (www.gtb.gov.tr).

Prohibitions, Controls and Permits on Imported Goods

In this framework, if any, the investigation of the demand for documents such as standards, guarantee certificate, inspection certificate, inspection certificate, health certificate, analysis report, CE certificate etc., which are subject to restrictions such as prohibition, permit, quota, special customs application etc It is very important to do pre-prepare. This information can be accessed from the Ministry of Economy (www.ekonomi.gov.tr), Ministry of Customs and Trade (www.gtb.gov.tr) and Istanbul Chamber of Commerce (www.ito.org.tr).

Checking the Status of the Legislation to be Imported Before Importation

Foreign trade legislation is subject to frequent changes. Therefore, even if the goods have been imported before the introduction of the import activity, it is necessary to review the legislation.

Learning the customs tax applied to the product to be imported

It is possible to obtain information on the tariff rates to be applied in imports on the website of the Ministry of Economy (www.ekonomi.gov.tr). However, since the customs duty rate may have changed, it is possible to obtain information from the trade and / or industry chambers, customs consultancy companies or the internet portals which include the updated legislation in electronic media by specifying the import country on the basis of custom tariff number.

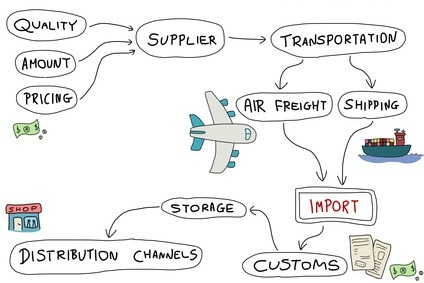

Shipping

Each transport route has its advantages and disadvantages. Which way to choose the transportation of imported goods; it depends on the product, the importer's needs, the route of the country of the exporter. Price, due date, special conditions related to the product are important to bear in mind regarding transportation.

Packaging;

It is an important element in terms of ensuring safe transportation of imported goods from the producer to the consumer. While packaging, product-specific features and needs to be remembered. All information on the packaging should be provided with clear, water-resistant ink.

Interview

After the connection with the potential seller, the importer and the exporter should discuss the issues mentioned below;

• The name, type, quality of the product to be imported,

• Whether or not to make a sample of the required property,

• Type of packaging,

• Validity of the price and price requested by the seller for the product,

• Import amount and its effect on price,

• Payment methods and bank guarantees

• Whether an advance payment is made or not,

• Delivery times and loading times of goods to be imported,

• Transport,

• The documents required for the importation of the products to be made in accordance with our legislation,

• After-sales warranties, spare parts and service trainings.

Sales Agreement

It is useful to create a sales contract that includes goods movement or currency movement against all risks that may occur in the trade of goods subject to importation, although not mandatory.

Payment of Import Prices

In order to regulate the reciprocal movement of goods and goods subject to trade in foreign trade between the parties, various payment methods such as prepayment, goodwill, voucher, letter of credit, acceptance credit are available.

It is very important for importers to determine the most appropriate payment method which is accepted by the exporters.

Customs Control in Imports

Because import is very important in terms of tax revenues of the state, importers should not underestimate that import duties in the customs are strictly controlled and that imports may have some implications for non-tariffs due to the negative impact of imports on domestic production.

Correct Notification Of Origin Of Imported Goods

Most of the preferential tariff applications and trade policy measures depend on the origin of the goods. Therefore, the origin of the goods must be declared correct.

Counterfeit Goods

If it shows that it is manufactured in a country other than the country where it is produced or if it carries the name or symbols that give rise to such an impression, it is not allowed to import because it is an object of false origin.

Importance of Proper Documentation of Customs Clearance

Import customs operations should be considered. If there are deficiencies on the basis of documents in the customs stage, the goods may stay longer than expected at customs and additional costs such as demurrage, reimbursement or return of goods (return to the country of origin) may be incurred. Importance should be given to customs clearance and financing of imports.

Obtaining Permission Certificates

People wishing to import should apply directly to the customs authorities with the documents they need to take in accordance with the relevant legislation.

In the importation of some products, some documents must be received or approved by the relevant institutions and organizations in accordance with the below mentioned communiqués.

• Certificate of Conformity from TSE,

• Control Certificate from Ministry of Food, Agriculture and Livestock and Ministry of Health,

• Guarantee certificate to be approved by the Ministry of Science, Industry and Trade,

• Control Certificate / Certificate of Conformity / Chemical Material Import Certificate from Ministry of Environment and Urbanization,

• Import Monitoring Certificate / Surveillance Certificate from Ministry of Economy,

• Certificate of Conformity from Tobacco, Tobacco Products and Alcoholic Beverages Market Regulatory Authority.

It is obligatory to submit some documents from various institutions such as above before the import to the entrance customs office. Otherwise, imports are not allowed.

Exemption From The Documents Required For Importation Specified In The Notifications

It is very important to examine the related notifications about the documents that should be taken from the various institutions. Because, in the related notifications, many exemptions have been granted to the importing companies, provided that the conditions stated in the notifications regarding the provision of the requested document are met.

Possible documents to be submitted to the Customs Administration

• Original invoice,

• Asset notification form for imported goods,

• Certificate of origin,

• EUR.1 Movement Certificate (Free Trade Agreements covered by ECSC products and EU origin agricultural products), A.TR Movement Document (Customs Union Agreement in the importation of industrial and processed agricultural products),

• Check list,

• Lading or delivery receipt,

• Freight bill and / or insurance policy,

• Processed agricultural products declaration form / analysis report,

• Certificate of conformity

, • Compliance letter,

• Certificate of approval,

• Warranty certificate,

• Permission letter / permit,

• Fund receipt (receipt issued by bank or private financial institution deducting the Resource Utilization Support Fund for goods imported in accordance with term letter of credit, goods and acceptance and credit payment),

• Import license,

• Inspection certificate.

Inspection of the Purchased Goods after Arrival to the Land

The owners of the goods to be imported or those who are authorized to act in their place, to be able to make their statements correctly and not to face penalties due to the false declaration, to obtain the written permission from the customs office, provided that they have the temporary storage place under the supervision of temporary storage location and customs officers, such as the examination, not to be a commercial nature provided that they can take samples and make appraisal reviews.

Refund is possible if the goods are not suitable for the order. Performing a quality control at the loading stage in the export country can reduce costs.

Additional costs;

• Transport,

• Insurance,

• Clearance costs,

• Bank charges,

• Domestic transportation costs,

• Fund costs depending on payment method,

• Certification costs that may be required for the product